Insurance and Medication Changes: How to Navigate Formularies Safely in 2025

Formulary Cost Calculator

Estimate Your Medication Costs

- Ask your doctor for a formulary exception request

- Check if there's an equivalent drug covered at a lower tier

- Use a 30-day emergency supply if available

- Review your plan during Open Enrollment (October 15-December 7)

Every January, thousands of people wake up to a surprise: their medication is no longer covered-or it suddenly costs three times more. This isn’t a billing error. It’s a formulary change. If you take regular prescriptions, especially for chronic conditions like diabetes, high blood pressure, or depression, you’re not immune. Formularies are the hidden rulebooks that decide which drugs your insurance pays for, and when they change, your wallet-and your health-can be affected.

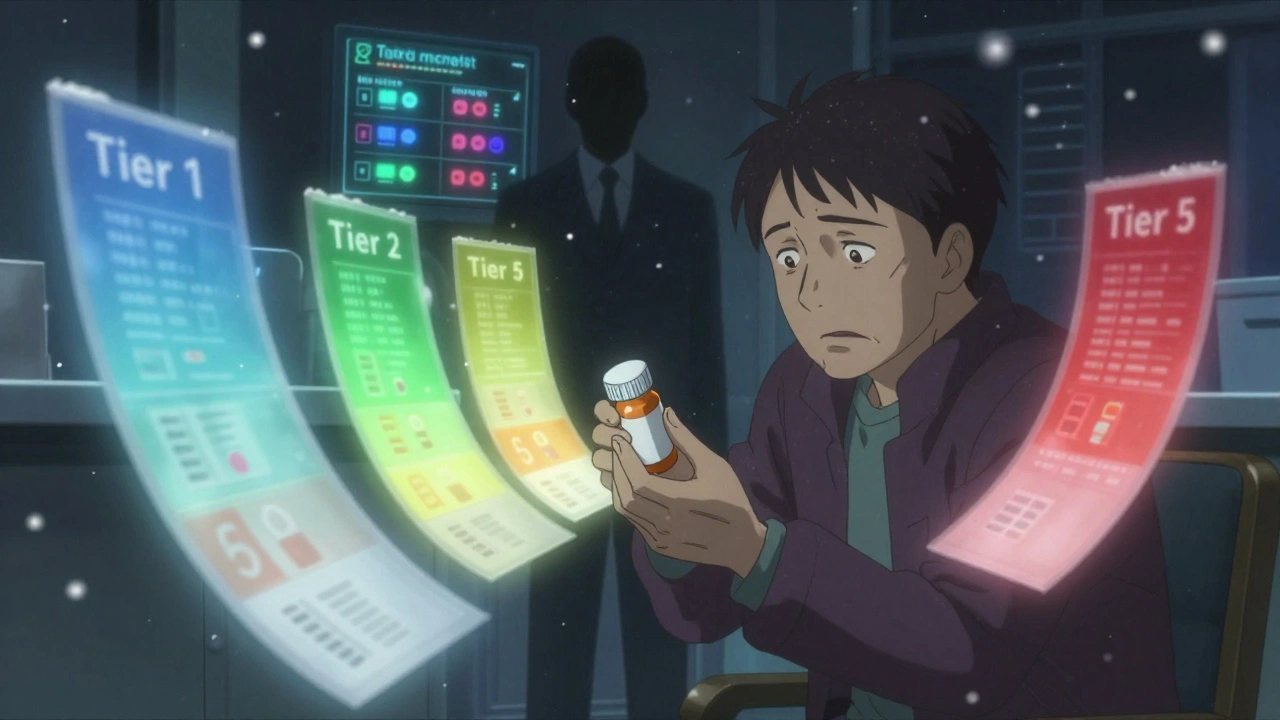

What Exactly Is a Formulary?

A formulary is a list of prescription drugs your health plan covers. It’s not random. It’s created by teams of doctors and pharmacists who pick medications based on three things: how well they work, how safe they are, and how much they cost. Most plans use a tier system to make it easier to understand. Think of it like a pricing ladder:- Tier 1: Generic drugs. Usually $0-$10 per fill.

- Tier 2: Preferred brand-name drugs. Around $25-$50.

- Tier 3: Non-preferred brand-name drugs. $50-$100.

- Tier 4/5: Specialty drugs. Often $100+, or you pay a percentage of the total cost.

Why Do Formularies Change?

Formularies aren’t set in stone. They’re updated every year, usually on January 1. But changes can also happen mid-year. About 23% of plans make adjustments outside the annual cycle. Why? Several reasons:- A new generic drug hits the market and becomes the new standard.

- A drug’s manufacturer raises prices too sharply.

- A new, more effective drug is approved and the plan wants to offer it.

- The pharmacy benefit manager (PBM) negotiates a better deal with a different brand.

Medicare vs. Commercial Plans: Key Differences

If you’re on Medicare Part D, you have more protections than someone with employer insurance. For example:- Medicare plans must cover all drugs in six protected classes: antidepressants, antipsychotics, immunosuppressants, anti-epileptics, HIV/AIDS drugs, and cancer treatments.

- Commercial plans can exclude any of these entirely.

- Medicare plans must give you 60 days’ notice before removing a drug. Commercial plans only need 30 days.

- Medicare requires plans to cover at least two drugs in every therapeutic category. Commercial plans don’t have that rule.

What Happens When Your Drug Gets Removed?

Imagine you’ve been taking a specific blood pressure pill for five years. You know how it works. You don’t have side effects. Then, one day, your copay jumps from $30 to $450. Or worse-it’s not covered at all. This isn’t rare. In 2022, 12.7% of Medicare beneficiaries had at least one medication removed from their formulary. About 3.2% struggled to get a replacement. One Reddit user shared: “My heart medication moved from Tier 2 to Tier 4 overnight. I went from $45 to $450 a month. Took seven phone calls and three weeks to get an exception.” But not all stories are bad. Some people get lucky. One Medicare user had their diabetes drug removed, but their doctor filed an exception-and it was approved in 48 hours with no cost increase. The difference? Documentation. If your doctor can prove you’ve tried alternatives and had bad reactions, or that the new drug won’t work for you, approval rates jump to 78%.How to Check Your Formulary Before It’s Too Late

You can’t rely on your insurer to notify you. Most people don’t even know where to find the formulary. A 2023 Consumer Reports survey found 68% of Medicare beneficiaries had trouble locating their plan’s drug list online. Here’s how to do it right:- Find your exact plan name. It’s on your insurance card.

- Go to your insurer’s website during Open Enrollment (October 15 to December 7 for Medicare).

- Look for “Drug List,” “Formulary,” or “Prescription Coverage.”

- Search for each medication you take. Don’t just check the name-check the generic too.

- Write down the tier and any restrictions (like prior authorization or step therapy).

What to Do If Your Drug Is Removed

If your medication is taken off the formulary, you have options:- Ask for a formulary exception. Your doctor submits a letter explaining why the alternative won’t work. Approval rates are highest for cancer meds (92%) and lowest for skin conditions (65%).

- Try a therapeutic alternative. Is there another drug in the same class? For example, if your statin is removed, another statin might be covered.

- Use a 30-day emergency supply. Some plans allow this while your exception is processed.

- Switch plans. During Open Enrollment, you can move to a plan that covers your drug. Use the Medicare Plan Finder tool.

Big Changes Coming in 2025

The Inflation Reduction Act is changing the game. Starting January 1, 2025:- Medicare Part D beneficiaries will pay no more than $2,000 a year out-of-pocket for prescriptions.

- Insulin will remain capped at $35 per month.

- Medicare will start negotiating prices for 10 high-cost drugs in 2026, with more added each year.

How to Stay in Control

Formularies aren’t going away. They’re here to stay. But you don’t have to be powerless.- Check your formulary every October. Don’t wait for a letter.

- Ask your pharmacist: “Is this drug still covered?” They see formulary updates daily.

- Keep a written list of your meds, doses, and any side effects.

- When switching plans, compare formularies side-by-side-not just premiums.

- If you’re on multiple medications, focus on the ones with the highest copays or the most restrictions.

Real Talk: What Patients Are Saying

On AgingCare.com, a caregiver wrote: “My mother’s dementia drug was removed. The insurance company found an equivalent, coordinated with her neurologist, and switched her with zero cost increase.” But another case from the National Council on Aging tells a different story: a 72-year-old cancer patient went 21 days without her drug because the plan removed it without warning. She ended up in the hospital. The difference? Proactivity. One person checked. One didn’t.Final Thoughts

Formularies are designed to save money. But they can also save lives-if you know how to use them. The key isn’t fighting the system. It’s understanding it. Know your meds. Know your plan. Know your rights. And never assume your coverage stays the same.What is a formulary and why does it matter?

A formulary is your health plan’s official list of covered prescription drugs. It determines which medications you can get at a lower cost and which ones require extra steps or aren’t covered at all. If your drug isn’t on the list-or it’s moved to a higher tier-you could pay hundreds more per month. Formularies directly impact your out-of-pocket costs and access to treatment.

How often do formularies change?

Most formularies update once a year on January 1, aligning with the new plan year. But about 23% of plans make changes mid-year. Medicare plans must give you 60 days’ notice before removing a drug. Commercial plans only need 30 days. Always check your formulary during Open Enrollment (October 15-December 7 for Medicare) to avoid surprises.

How do I find my plan’s formulary?

Go to your insurer’s website and search for “Drug List,” “Formulary,” or “Prescription Coverage.” You’ll need your exact plan name, which is on your insurance card. Medicare beneficiaries can use the Medicare Plan Finder tool. If you can’t find it, call customer service and ask for the current formulary document in PDF format. Don’t rely on email notices-they’re often vague or missed.

What’s the difference between Tier 1, Tier 2, and Tier 3 drugs?

Tier 1 drugs are generics and usually cost $0-$10. Tier 2 are preferred brand-name drugs, costing $25-$50. Tier 3 are non-preferred brand-name drugs, costing $50-$100. The higher the tier, the more you pay. Some plans have Tier 4 or 5 for specialty drugs-these can cost $100+ or require a percentage of the drug’s total price. Always check the tier before filling a prescription.

Can I get an exception if my drug is removed?

Yes. Your doctor can file a formulary exception request. Approval is most likely if you’ve tried other drugs and had side effects, or if the alternative won’t work for your condition. Medicare and commercial plans approve about 78% of these requests when submitted properly. Keep records of your medical history and pharmacy claims to support your case.

Will the Inflation Reduction Act change my formulary?

Yes. Starting in 2025, Medicare Part D beneficiaries will pay no more than $2,000 a year out-of-pocket for prescriptions. Insulin is capped at $35/month. These changes may lead insurers to adjust formularies-some drugs may be moved to lower tiers to meet cost caps, while others might be removed if they’re no longer cost-effective under the new rules. Always compare plans during Open Enrollment.

What should I do if my medication is suddenly not covered?

Don’t stop taking it. Contact your pharmacy first-they may have a 30-day emergency supply. Then call your doctor to request a formulary exception. Ask if there’s a covered alternative with similar effectiveness. Check if your plan offers a transition policy for ongoing prescriptions. If all else fails, switch plans during Open Enrollment. Never wait until your prescription runs out.

Are generic drugs always better than brand-name drugs?

For most medications, yes. Generic drugs contain the same active ingredients and meet the same FDA standards as brand-name versions. They’re tested to be equally effective and safe. But for some drugs-like narrow-therapeutic-index medications (e.g., warfarin, levothyroxine)-small differences in formulation can matter. If you’ve been stable on a brand-name drug, ask your doctor before switching to generic. Always monitor for changes in how you feel.

iswarya bala

December 9, 2025 AT 10:21Anna Roh

December 10, 2025 AT 07:44Raja Herbal

December 11, 2025 AT 18:24Delaine Kiara

December 12, 2025 AT 20:11Noah Raines

December 14, 2025 AT 05:41Lola Bchoudi

December 15, 2025 AT 04:06Morgan Tait

December 15, 2025 AT 04:28Darcie Streeter-Oxland

December 15, 2025 AT 17:40Sarah Gray

December 15, 2025 AT 18:12