Extra Help Program for Low-Income Seniors: How to Qualify for Prescription Drug Savings

If you’re a senior on Medicare and struggling to pay for your medications, you’re not alone. In 2025, over 15.8 million Medicare beneficiaries rely on the Extra Help Program to cut their drug costs-many without even knowing they qualify. This federal program, officially called the Part D Low Income Subsidy (LIS), can reduce your monthly premiums, eliminate your deductible, and cap your copays at just $1.60 for generics and $4.80 for brand-name drugs. But here’s the catch: nearly 4.3 million eligible seniors are still missing out, leaving an estimated $26.8 billion in free assistance on the table.

Who Exactly Qualifies for Extra Help?

You don’t need to be broke to qualify. The income limits for 2025 are $23,475 per year for a single person and $31,725 for a married couple living together. These aren’t strict ceilings-they’re starting points. The Social Security Administration doesn’t count every dollar you make. The first $20 of monthly income is ignored. The first $65 of earned income (like from a part-time job) is also ignored, and half of what’s left after that doesn’t count either. If you get money from a child in the military, that’s excluded too. Many seniors think they make too much, but after these exclusions, they’re well under the limit.

Resources matter too. You can have up to $17,600 in countable assets as an individual, or $35,130 as a couple. But here’s what doesn’t count: your home, one car, household goods, jewelry, and up to $1,500 set aside for burial expenses. A savings account with $10,000? That counts. A retirement account with $20,000? That counts. But your house? Not even close.

And if you’re already getting Supplemental Security Income (SSI), Medicaid, or state help paying your Medicare Part B premiums, you’re automatically enrolled. No application needed. About 28% of all Medicare Part D enrollees fall into this group-over 12 million people.

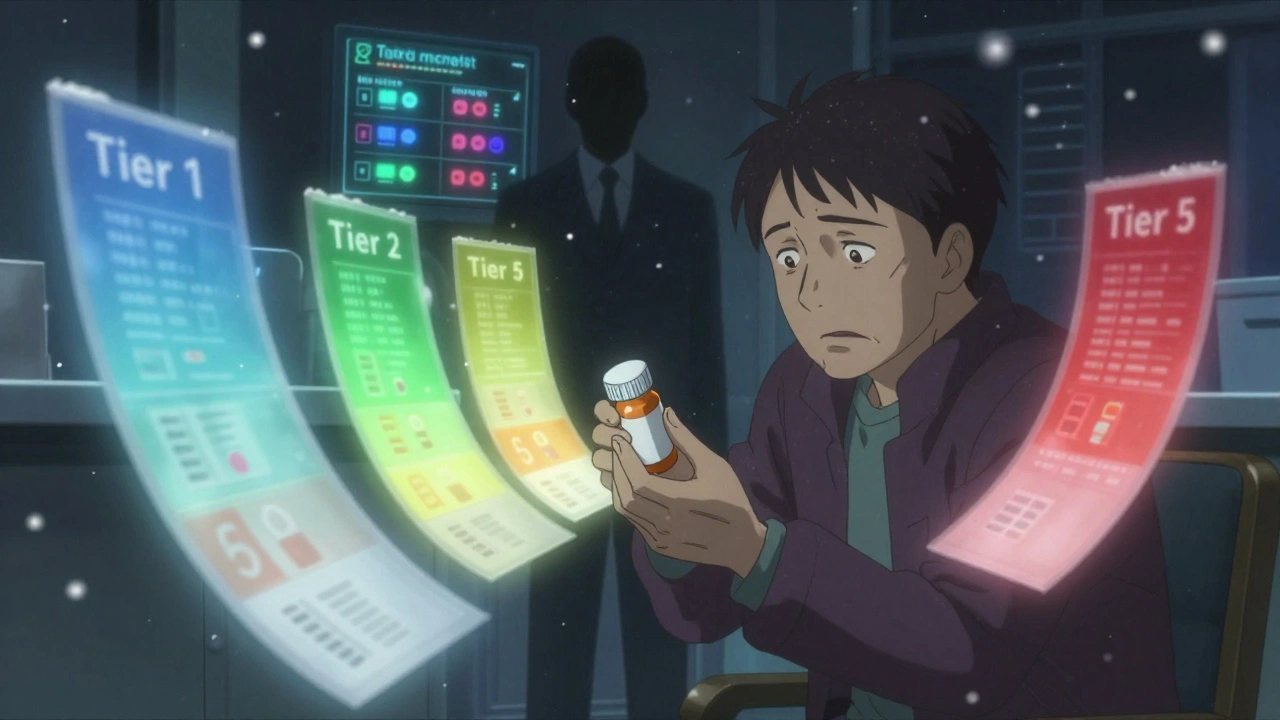

What Does Extra Help Actually Cover?

It’s not just a discount. It’s a full reset of your prescription drug costs. If you’re enrolled, you pay $0 for your Part D monthly premium-if you choose a plan with a $0 premium (and there are usually 2 to 7 such plans in every state). Your annual deductible? Gone. The standard $595 deductible in 2025? You don’t pay it. Ever.

Your copays are capped based on your income. If your income is at or below 100% of the Federal Poverty Level, you pay no more than $1.60 for generic drugs and $4.80 for brand-name ones. If you’re between 100% and 150%, you pay up to $4.90 for generics and $12.15 for brand-name drugs. Compare that to the average out-of-pocket cost of $1,200 a year for seniors without Extra Help. This program cuts that by 83%.

And here’s something many don’t know: you’re protected from the late enrollment penalty. If you didn’t sign up for Part D when you were first eligible, you’d normally pay a 1% monthly surcharge on the national base premium ($35.34 in 2025) for every month you went without coverage. With Extra Help, that penalty disappears. You can enroll anytime without paying extra.

Starting in 2025, you also pay no more than $35 per month for insulin and $0 for recommended vaccines like shingles and flu shots-no matter your income level. These benefits, added under the Inflation Reduction Act, used to be limited to partial Extra Help recipients. Now, everyone gets them.

How to Apply: Three Ways to Get Started

If you’re not automatically enrolled, applying is simple. You have three options:

- Online: Go to SSA.gov/extrahelp. The application takes about 15 minutes. You’ll need your Social Security number, Medicare number, and details about your income and assets.

- By phone: Call 1-800-772-1213 (TTY: 1-800-325-0778). Hours are 8 a.m. to 5:30 p.m. Monday through Friday. You can request a paper form be mailed to you or complete the application over the phone.

- In person: Visit your local Social Security office. Bring your ID, proof of income (tax return, Social Security statement, or pay stubs), and proof of assets (bank statements, investment account summaries).

Most applications are processed in 21 days. About 72% of first-time applicants are approved. The most common mistakes? Miscounting income by including excluded amounts (like the first $20/month), overvaluing assets (like listing your home as an asset), or forgetting to include all sources of income. If you’re unsure, ask a local senior center or Area Agency on Aging for help. They’ve helped thousands get approved.

What If You’re Just Above the Income Limit?

You might still qualify. The rules are designed to be flexible. If you have high medical bills, some of your expenses can be subtracted from your income. If you pay for long-term care, or have a dependent living with you, those can reduce your countable income. Even if your income is slightly over the limit, you might still get partial help-though the 2024 reforms eliminated the old partial category, so now it’s all or nothing. But don’t assume you’re disqualified. Apply anyway. The SSA will calculate what counts and what doesn’t.

One real example: A 78-year-old widow in Ohio receives $2,100 a month from Social Security and $300 from a small pension. She owns her home and drives an old car. She has $14,000 in savings. Her total income is $28,800-above the $23,475 limit. But she also pays $1,800 a year in home health care. That’s subtracted. Her countable income drops to $27,000. Still too high? Not quite. The SSA also excludes the first $20 of monthly income. That’s $240 a year. And her pension income is partially exempt. After all adjustments, her countable income falls to $22,900-under the limit. She got approved.

What Happens After You’re Approved?

Once approved, you’ll get a letter from Social Security confirming your Extra Help status. If you’re already enrolled in a Medicare Part D plan, your copays will automatically drop to the Extra Help levels. If you’re not enrolled, Social Security will enroll you in a plan with a $0 premium-usually the lowest-cost option in your area. You’ll get a new Medicare card in the mail, and your pharmacy will be notified. Within 45 days, your drug costs should reflect the new savings.

You don’t need to reapply every year. Extra Help is automatically renewed as long as your situation doesn’t change dramatically. But if your income goes up, your assets grow, or you move out of state, you must report it. Otherwise, you could be overpaid and asked to pay back funds.

Why So Many Seniors Miss Out

The Government Accountability Office found that 4.3 million eligible seniors aren’t enrolled. Why? Many think they make too much. Others don’t know the program exists. Some assume it’s too complicated. A lot of seniors are told by pharmacists or friends, “You don’t qualify,” without checking the details.

There’s also a stigma. Some seniors feel embarrassed to ask for help. Others believe it’s for people on welfare, not for “hardworking people” who just had a few medical bills. But Extra Help isn’t welfare. It’s a benefit you paid into through your taxes and payroll deductions. It’s there for you.

The Social Security Administration launched a new automated screening tool in February 2025 that scans your Social Security records to see if you might qualify-even if you’ve never applied. It’s hidden on SSA.gov, but it’s real. If you’re over 65, have Medicare, and live on a fixed income, it’s worth checking.

Next Steps: What to Do Right Now

If you or someone you love is a senior on Medicare and takes prescription drugs, here’s what to do:

- Check your current Part D plan’s monthly premium and copays. If they’re over $20 a month for drugs, you might be paying too much.

- Call 1-800-772-1213 and ask, “Do I qualify for Extra Help?” No need to prepare documents first-they’ll tell you what you need.

- Visit SSA.gov/extrahelp and use the online application. It’s secure and takes less than 20 minutes.

- Ask your local Area Agency on Aging or senior center for help. They offer free one-on-one counseling.

- If you’re denied, appeal. Many denials are overturned after review.

Don’t wait. Every month you delay costs you hundreds. The average Extra Help beneficiary saves $6,200 a year on drugs. That’s a new furnace, a roof repair, or a year of groceries. It’s not charity. It’s your benefit.

Do I qualify for Extra Help if I have savings in a retirement account?

Yes, retirement accounts like IRAs and 401(k)s count as resources. But you can still qualify if your total countable assets are under $17,600 (individual) or $35,130 (couple). Your primary home, one car, and personal belongings don’t count. The SSA looks at your total liquid assets-not just your bank account.

Can I get Extra Help if I’m not on Medicaid?

Absolutely. Extra Help is separate from Medicaid. You don’t need to be on Medicaid to qualify. Many seniors get Extra Help without any other government assistance. All you need is to meet the income and resource limits for Medicare Part D.

What if my income changes next year?

Extra Help is reviewed automatically each year. If your income goes up, you may lose eligibility. If it goes down, you might qualify for more help. You don’t need to reapply unless your situation changes significantly. But if you get a raise, inherit money, or sell property, report it to Social Security within 10 days.

Does Extra Help cover all my medications?

Extra Help doesn’t cover every drug, but it covers all drugs on your plan’s formulary. Your Part D plan must include at least two drugs in each common category, and Extra Help ensures you get them at the lowest possible cost. If your medication isn’t covered, you can request an exception. Your pharmacist can help you file it.

Is there a deadline to apply for Extra Help?

No. You can apply anytime during the year. Unlike Medicare Open Enrollment, Extra Help has no cutoff date. The sooner you apply, the sooner your drug costs drop. If you apply in November, your savings can start as early as January.

If you’re unsure, just call. There’s no risk in applying. The worst that happens is you’re told you don’t qualify. The best? You save thousands a year on pills you need to stay healthy.

Asia Roveda

November 27, 2025 AT 04:40So let me get this straight - the government gives free drug money to people who can’t even count their own savings? My grandma worked 40 years, paid taxes, never asked for a thing - now some guy with $14k in the bank gets $6k a year in free meds? This isn’t help, it’s reward for bad planning. And don’t get me started on how they count ‘assets’ - your house doesn’t count but your 401k does? What kind of logic is that?

Micaela Yarman

November 27, 2025 AT 15:33It is with profound respect for the dignity of our aging population that I submit this observation: the Extra Help Program represents a critical fulcrum in the social contract between the state and its elderly citizens. The structural design of income exclusions - particularly the $20 monthly disregard and the earned income allowance - demonstrates a nuanced understanding of economic reality. One must not conflate financial prudence with moral worthiness. To deny assistance based on perceived ‘deservingness’ is to misunderstand the very nature of social insurance.

mohit passi

November 29, 2025 AT 00:17bro this is beautiful 🙏 real talk - if you’re 70 and taking 5 pills a day and your paycheck is $1800/month, you’re not ‘rich’ you’re just surviving. the system is rigged to make you feel guilty for needing help but this? this is your money back. no shame. no guilt. just breathe. you earned this 💪

Kaushik Das

November 30, 2025 AT 22:35Man, I’ve seen so many folks in my neighborhood just give up because they think they make ‘too much’ - like, they’re making $25k a year and think that’s the end of the world. But then you dig into the fine print - first $20 ignored, half their part-time cash doesn’t count, their pension gets chopped up - suddenly they’re under the line. I helped my aunt apply last year. She cried when she saw her insulin copay drop from $45 to zero. That’s not welfare. That’s justice with a paperwork form.

Cynthia Springer

December 1, 2025 AT 17:55I’m confused - if you’re automatically enrolled if you get SSI or Medicaid, why do so many people still not know about it? Is there no outreach? No letters? No phone calls? I feel like if this were a new iPhone feature, everyone would know. But for something this vital, it’s buried on a .gov site like a secret code. Who’s responsible for making sure people know this exists?

Joe bailey

December 3, 2025 AT 14:38Just applied last week. Took 12 minutes online. Got approved in 14 days. My monthly script cost went from $187 to $12. That’s a Netflix subscription gone. And I didn’t even know I qualified. Don’t overthink it. Just click the link. You’ve got nothing to lose and thousands to gain. Seriously. Do it today.

Amanda Wong

December 4, 2025 AT 17:27Let’s be real - this program is a disaster waiting to happen. They’re giving out free drugs to people who could easily afford them, and now we’re going to have a whole generation of seniors who think healthcare is free. Next thing you know, they’ll be demanding free dental, free hearing aids, free wheelchairs. This isn’t help - it’s entitlement culture on steroids.

Stephen Adeyanju

December 5, 2025 AT 02:26my uncle got denied because he had $17k in savings but his car was worth $8k and they counted it as an asset even though it’s a 2005 Honda. he called SSA 7 times. they told him to ‘reapply with corrected docs’ but didn’t tell him what was wrong. then he died 3 months later. his meds cost him $300 a month. he never got it. this system is broken

james thomas

December 6, 2025 AT 20:41you ever notice how the SSA never checks if you’re on a secret offshore account but they’ll audit your bank statement like you’re a drug dealer? this program is a front. the real goal is to get seniors to sign up for Medicare Advantage plans so Big Pharma can push their overpriced generics. they don’t care if you get help - they care if you get locked into their system. don’t trust the form. don’t trust the website. call the number. talk to a human. they’re the only ones who won’t lie to you

Sanjay Menon

December 7, 2025 AT 09:50As a Canadian with a PhD in public policy, I find this program both admirable and deeply flawed. The income thresholds are too rigid, the asset limits archaic, and the bureaucratic inertia staggering. While the intent is noble, the execution betrays a profound disconnect from the lived reality of aging in late-stage capitalism. One must question whether the state’s role should be to merely subsidize pharmaceutical monopolies rather than reform the entire pricing architecture. This is band-aid economics dressed as compassion.

Marissa Coratti

December 8, 2025 AT 15:16It is imperative that we recognize the structural inequities embedded within the current implementation of the Extra Help Program. While the program itself is a vital lifeline, its accessibility is hindered by systemic barriers including digital illiteracy, geographic isolation, linguistic disparities, and the pervasive stigma surrounding the receipt of public benefits. Furthermore, the reliance on self-reporting of income and assets without proactive verification mechanisms creates a precarious environment wherein eligible individuals are inadvertently disqualified due to misunderstandings or incomplete documentation. The Social Security Administration must adopt a more proactive, outreach-driven model - one that includes community-based navigators, multilingual support, and automated eligibility screenings that do not require seniors to become experts in federal benefit code. The moral imperative is clear: no senior should be forced to navigate a labyrinth of bureaucracy to access a benefit they have earned through decades of labor and taxation. The time for passive information dissemination has passed. We must now embrace active, compassionate, and human-centered service delivery.